Manufacturing Matters

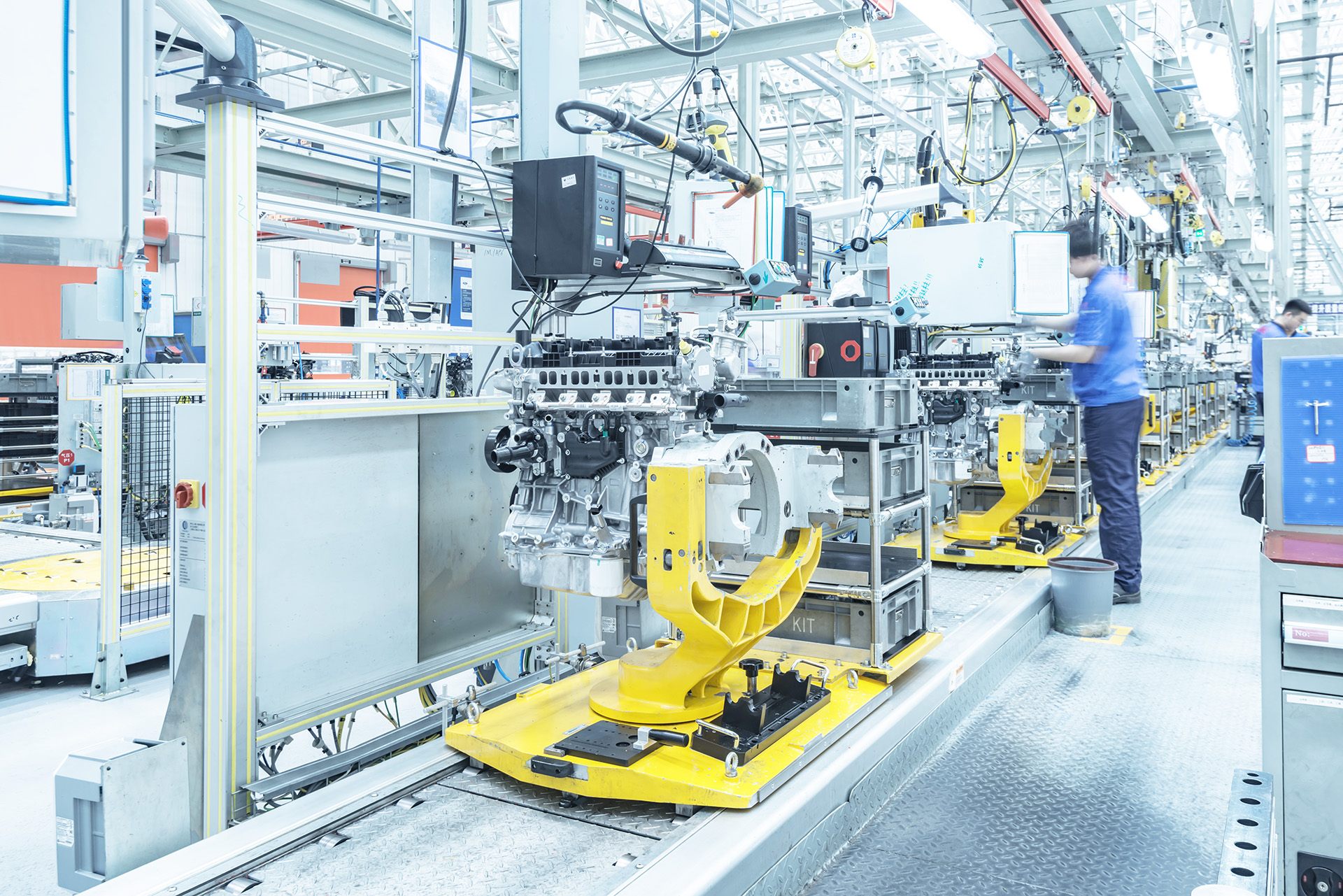

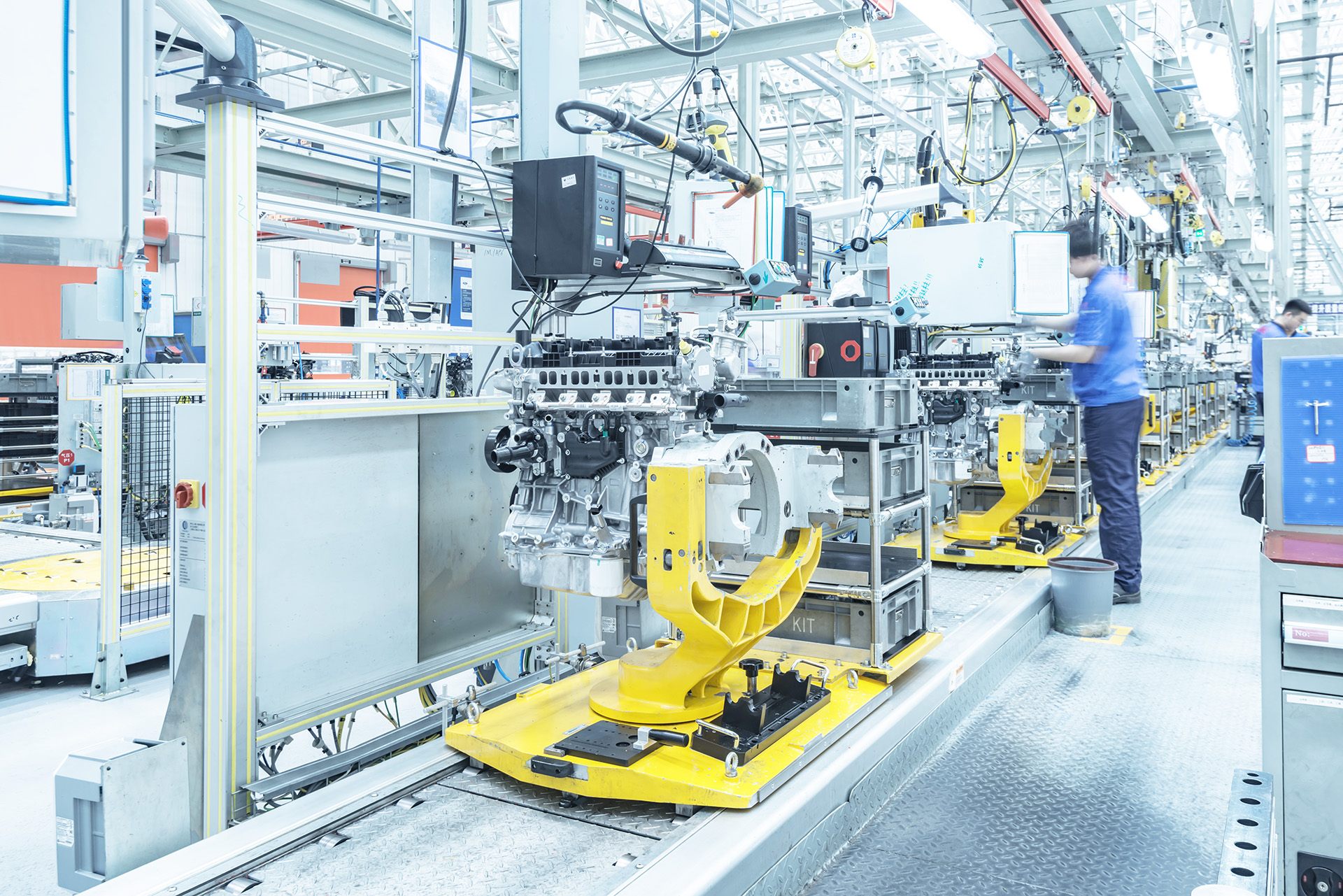

Manufacturing is the driving force behind the Texas economy, setting the stage for a secure future built on innovation and industry.

A diverse array of Texas-made products bolsters our national security, fortifies our economy and reduces our dependence on other nations for critical components of our supply chain. And for 20+ years, Texas has been the number one exporting state for manufactured goods – delivering economic security and stability to trade allies around the globe.

The Texas Association of Manufacturers (TAM) champions this critical sector, advocating for over 500 member companies that range from small startups to some of the world’s largest enterprises. Our mission is to shape policies and foster partnerships that enhance global competitiveness and ensure sustained growth for the Texas economy. Through advocacy, education, and collaboration, TAM ensures that manufacturing continues to be a cornerstone of prosperity for Texas and the nation.

Texas manufacturers employ more than 967,000 Texans.

Annual compensation for jobs in the manufacturing sector is more than $116,000, roughly 36 percent higher than other non-farm Texas workers.

On average, each manufacturing job created provides 5 additional jobs in our communities.

Approximately 70 percent of all private-sector R&D in the U.S. comes from the manufacturing sector, driving more innovation than any other sector in our economy.

Texas manufacturers exported $293 billion in manufactured goods in 2024. Texas has been the nation’s #1 exporting state for more than 20 years.

IN THE SPOTLIGHT

Joins an accomplished network of leaders making a difference in our nation; will learn from the presidential leadership of George W. Bush, William J. Clinton, George H.W. Bush, and Lyndon B. Johnson

AUSTIN – Wroe Jackson, executive vice president and general counsel for the Texas Association of Manufacturers (TAM), has been named one of 60 Scholars who will form the Presidential Leadership Scholars’ (PLS) 11th annual class. Over the past decade, PLS has brought together nearly 600 established, purpose-driven leaders to collaborate and make a difference in the world as they learn about leadership through the lens of the presidential experiences of George W. Bush, William J. Clinton, George H.W. Bush, and Lyndon B. Johnson.

The class was selected after a rigorous application and review process. Scholars were chosen based on their leadership growth potential and the strength of their personal leadership projects aimed at addressing a critical challenge or need in a community, profession, or organization.

Wroe Jackson is a widely respected leader in Texas public policy with deep experience in law, government, and industry. Since 2019, he has led the Texas Association of Manufacturers’ strategic planning initiatives, legislative and regulatory advocacy, membership support and recruitment, and coordination across the Association’s executive leadership. As TAM’s general counsel, Jackson serves as the chief legal advisor to the organization and its members, providing strategic counsel and representing Texas manufacturers before federal agencies and state legislative and regulatory bodies.

Jackson’s public service career includes senior leadership roles as chief of staff and general counsel to Senator Joan Huffman, general counsel to three Texas Secretaries of State, and positions with the U.S. Department of Justice and then-Governor Rick Perry’s office.

He holds a bachelor’s degree from Vanderbilt University in Public Policy Studies and earned his Juris Doctor from St. Mary’s University School of Law.

“It is an honor to join 59 other incredible professionals to form the Presidential Leadership Scholars Class of 2026,” said Jackson. “I look forward to getting to know these proven leaders from across the country who are committed to facing critical challenges in their communities and around the world. I am eager to learn from the work of Presidents Johnson, Bush, Clinton, and Bush, and apply that knowledge to the important work we do at TAM every day.”

During the six-month program, Jackson will develop his initiative focused on workforce and career development, with an emphasis on pathways into public service. Drawing on his experience across government, law, and industry, he hopes to support and inspire young professionals who are working in – or aspiring to – careers in public service through mentorship, professional networking opportunities, and practical guidance.

“Wroe’s selection as a Presidential Leadership Scholar is a testament to his commitment to public service,” said Tony Bennett, TAM president and CEO. “We are proud to see his leadership recognized at the national level and confident that his contributions as a member of this year’s PLS class will bring valuable insight to his fellow Scholars while helping to shape the future of public leadership nationwide.”

Over the course of the program, Scholars will travel to each participating presidential center to learn from former presidents, key former administration officials, business and civic leaders, and leading academics. They will study and put into practice varying approaches to leadership and exchange ideas to help strengthen their impact.

Scholars have consistently reported remarkable growth in skills, responsibilities, and opportunities for impact since the program began in 2015. For example, 93% of Scholars state they have a strong sense of purpose as a leader, and 100% of Scholars state they are inspired to accomplish and achieve more after completing the program.

The 2026 program will begin on Jan. 21 in Washington, D.C.

###

About Presidential Leadership Scholars

The Presidential Leadership Scholars program is a partnership among the presidential centers of George W. Bush, William J. Clinton, George H.W. Bush, and Lyndon B. Johnson. To learn more, visit www.presidentialleadershipscholars.org. For updates about the Presidential Leadership Scholars, use #PLScholars and follow @PLSprogram on LinkedIn, X, and Instagram.

The following column by TAM President & CEO appeared in the Fort Worth Star-Telegram on July 9, 2025. Photo: Robert Mallison, FWST

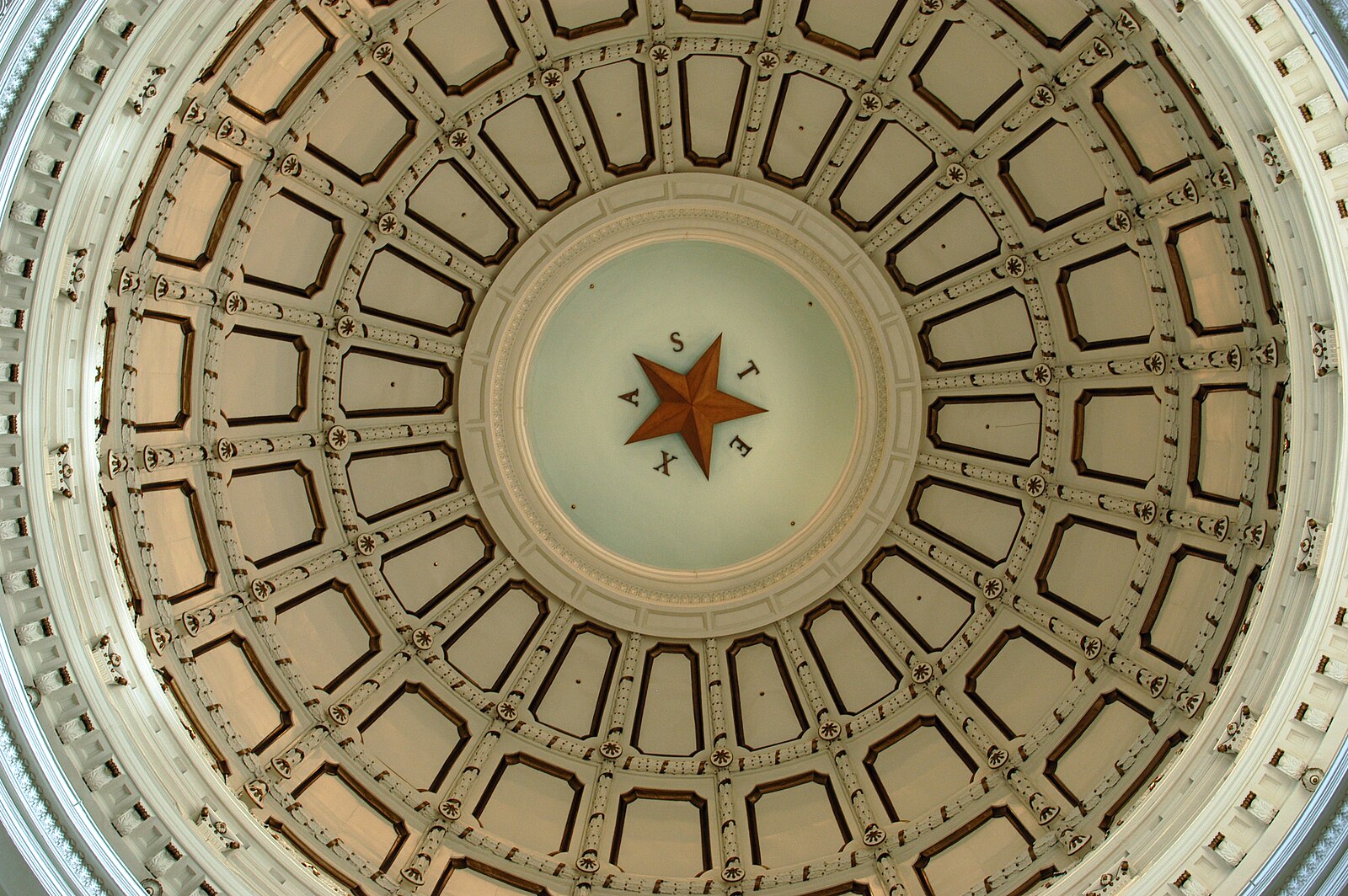

Texas is the nation’s top business state and leads the U.S. in adopting policies that support job creation and investment — the dual engines of our national and state economy. As a result, thousands of manufacturers, large and small, call Texas home, and we are proud of how they support our neighbors and innovate to drive the next great technological advancements.

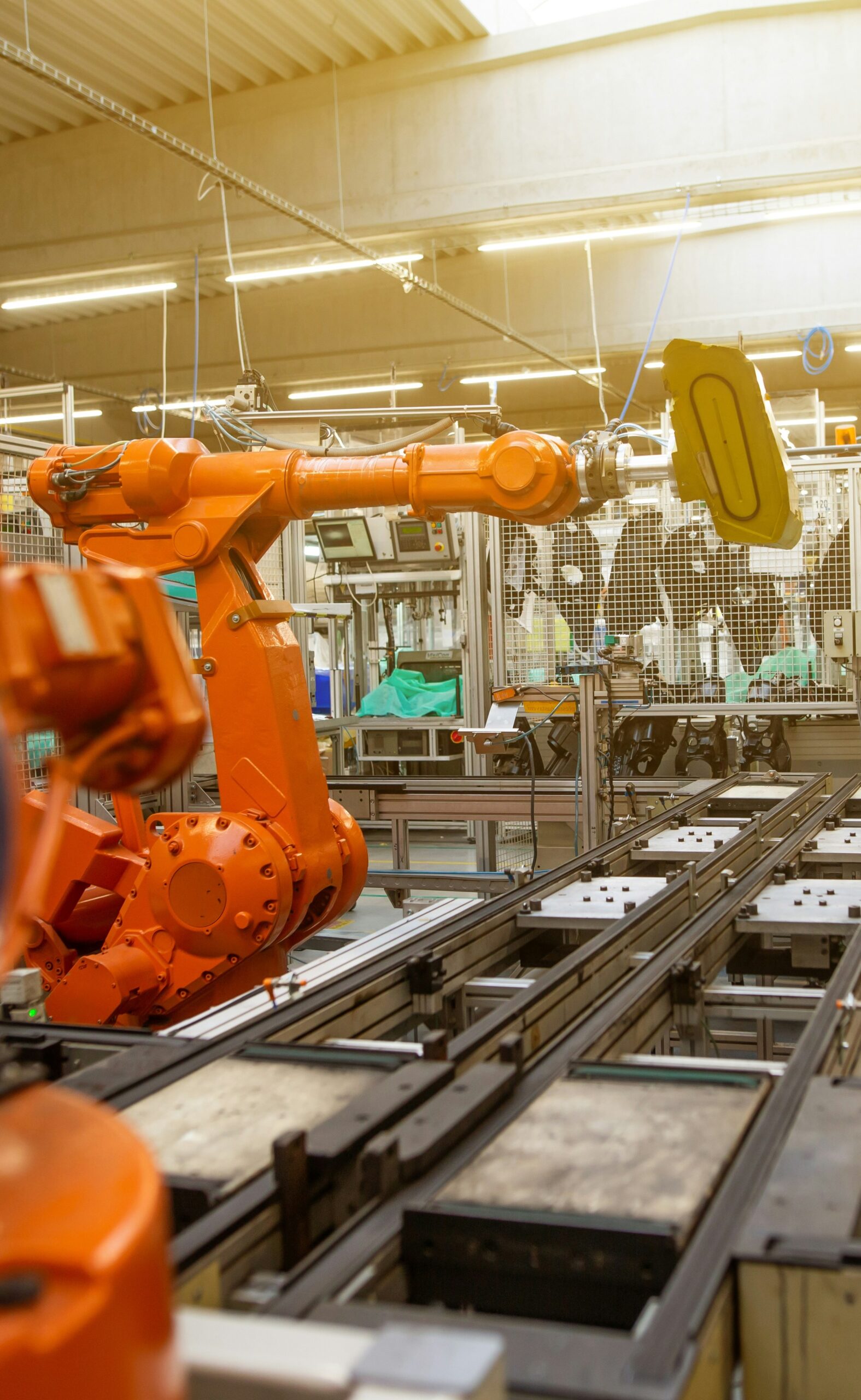

Manufacturing employs no fewer than 970,600 Texans, who work hard every day to build the future. A stunning display of future-ready advanced technology is rolling off an assembly line in Fort Worth right now: the F-35 Lightning II.

The F-35, with its cutting-edge stealth enhancements, boasts an impressive suite of capabilities to ensure the U.S. and our allies maintain air dominance. Our nation’s only fifth-generation fighter jet in production today, the F-35 is battle tested and combat proven, most recently in contested zones such as the Middle East.

Today, the F-35 provides warfighters in more than 20 nations with a decisive edge. As additional nations join the program, the F-35 enables the U.S. government to share interoperable air dominance capabilities with allies and partners, strengthening strategic deterrence around the world.

The F-35 is a game-changer, not only on the battlefield but also for our industrial economy. In Texas, we see that impact every day. While it is first and foremost a fifth-generation fighter, the F-35 is also one of the nation’s most powerful economic engines. The program anchors a vast manufacturing ecosystem and supports nearly 300,000 jobs nationwide, including more than 49,000 people in Texas.

The program generates an impressive $9.9 billion impact for our state’s economy every year — a figure that only grows thanks to the ripple effect of manufacturing, which averages an additional four jobs for every manufacturing job created. That means hundreds of thousands of American livelihoods and billions of dollars in economic impact are tied to this single aircraft and the industrial base behind it.

Gov. Greg Abbott recently recognized the impact of aviation in Texas by signing a state resolution designating Fort Worth as the “Aviation and Defense Capitol of Texas.” The F-35 is “exhibit A” for this moniker. The Air Force has touted the F-35 as the cornerstone of its fighting capabilities, and the Texas Association of Manufacturers could not be prouder to see the F-35 come to life in the heart of Texas.

Despite its unmatched pedigree, the F-35 now faces a different kind of dogfight, this one in the halls of Washington. Leveraging the F-35 program to bolster our military readiness and deter adversaries from acts of aggression requires more than intention; it requires investment.

In recent testimony before the House and Senate Armed Services Committees, senior defense leaders delivered a clear message: Rebuilding our military and achieving peace through strength is essential. Congress must act accordingly.

Air dominance has defined victory in battle for more than a century. Sustained investment in the F-35 program is essential to continue this legacy and the protection it affords.

Congress must prioritize F-35 production at scale, not only to revitalize our military but also to strengthen the industrial base that makes American security possible. With the stakes rising, the path to continued air dominance is clear.

Texans for Innovation issued the following statement after the Texas Legislature overwhelmingly passed Senate Bill 2206, extending the research and development tax incentive in Texas:

“The Texas Legislature sent a strong signal that the Lone Star State is serious about leading the world in advanced technology and innovation with the overwhelming passage of Senate Bill 2206, which extends and improves the state’s research and development (R&D) tax credit and reaffirms Texas as a top destination for innovation investment. Many thanks to Senator Paul Bettencourt and Representative Charlie Geren whose leadership will help the Texas innovation economy continue the important work of changing, saving and improving lives across the globe.”

+++

Texans for Innovation is a broad coalition of organizations that came together in support of R&D in Texas. Founding members of the coalition include the Texas Association of Manufacturers, Texas Taxpayers and Research Association, Texas Association of Business, Texas Healthcare and Bioscience Institute, Texas Chemistry Council, Texas Oil & Gas Association, Texas Economic Development Council, Dallas Regional Chamber, Greater Houston Partnership, North Texas Commission, Opportunity Austin, and Lockheed Martin.

The following can be attributed to Tony Bennett, president and CEO of the Texas Association of Manufacturers.

The Texas Association of Manufacturers thanks Chairman Phil King, Chairman Charles Schwertner, Chairman Ken King and their staff for their dedication and hard work in crafting a balanced outcome in Senate Bill 6, a bill that creates new tools to plan for and manage large electrical loads for business customers. The bill takes a measured, reasonable approach to bringing businesses with substantial electric demands to Texas. SB 6 makes clear that Texas remains open for business, while ensuring that customers large and small will have access to reliable, affordable power.

+++

The Texas Association of Manufacturers (TAM) actively represents more than 500 large and small companies from every manufacturing sector. Texas manufacturers employ more than 847,000 Texans in jobs that pay an average compensation of over $123,000 annually – roughly 36 percent higher than other non-farm Texas workers. Manufacturing accounts for 11.3 percent of the total output in the state, contributing more than $292 billion in 2023. On average, each manufacturing job created provides 5 additional jobs in our communities. Texas remains the number one exporting state for manufactured goods in the United States, now for more than 20 years running./

Media Contact: Gretchen Fox, 512-694-4326

The following can be attributed to Tony Bennett, president & CEO of the Texas Association of Manufacturers:

The Senate’s unanimous passage of SB 2206 to extend the state’s research and development (R&D) tax credit sends a strong signal that Texas is serious about leading the world in advanced technology and innovation. For many industries like manufacturing, high-tech, energy, and biotechnology, the R&D process represents the critical ‘first phase’ where questions, ideas, and problems are fleshed out in labs, the field, or production facilities to become the products and solutions that change, improve, and save lives. Encouraging this groundbreaking work through smart tax policy keeps Texas at the forefront of innovation, investment, and progress. The Texas Association of Manufacturers and our colleagues across the innovation economy thank Senator Paul Bettencourt for his leadership and understanding of what it takes to keep Texas on top in the global marketplace.

+++

The Texas Association of Manufacturers (TAM) actively represents more than 500 large and small companies from every manufacturing sector. Texas manufacturers employ more than 847,000 Texans in jobs that pay an average compensation of over $123,000 annually – roughly 36 percent higher than other non-farm Texas workers. Manufacturing accounts for 11.3 percent of the total output in the state, contributing more than $292 billion in 2023. On average, each manufacturing job created provides 5 additional jobs in our communities. Texas remains the number one exporting state for manufactured goods in the United States, now for more than 20 years running.

Media contact: Gretchen Fox, 512-694-4326

By Karoline Leonard, Austin American-Statesman

There are a lot of factors driving Texas’ booming technology and innovation sectors.

Praised for being one of the most “business-friendly” states in the nation, companies ranging from Fortune 500 powerhouses to smaller startups and ventures choose the Lone Star State for new factories, data centers, manufacturing facilities, satellite offices and headquarters.

But one area that Texas lags in is investment in research and development. As of 2022, Texas contributed only 4.3% of U.S. business-funded R&D. In contrast, California contributes 36.2% to the nation’s total business-funded R&D. Texas ranks 33rd nationally in R&D investment as a percentage of gross state product.

One research and development incentive is the state’s tax credit, but that program could go away as soon as December 2026.

Created in 2014 through House Bill 800, Texas’ R&D tax credit encourages economic development by offering qualifying entities either a sales tax exemption on personal property used in research or a franchise tax credit based on research expenses. According to the Texas Comptroller’s Office, approximately $2.8 billion in tax credits have been claimed since its inception. In fiscal 2024 alone, $412.7 million was claimed.

The program is set to expire Dec. 31, 2026, but on Wednesday, the Senate Finance Committee advanced a bill out of committee (13 ayes, no nays) that would extend the program, and the same major players from the 2013 legislative session are lobbying again to extend and improve the tax credit.

“Today, other states and global competitors are strengthening their R&D tax policies, driving new R&D and interest in AI development, industry reshoring back to North America and Texas and the recent tariff readjustment, which is a new thing,” Tony Bennett, president and CEO of the Texas Association of Manufacturers, testified during a Senate Finance Committee hearing Wednesday. “Texas must act now to retain our existing incentives and provide certainty for business and prevent the loss of critical existing investments.”

Senate Bill 2206 by Sen. Paul Bettencourt, R-Houston, — and its companion, House Bill 4393 by Rep. Charlie Geren, R-Lake Worth — would extend the R&D tax credit program and raise its incentive from about 5% to 8.72%, or about 10.9% of new R&D connected to state public and private higher education institutions.

“R&D is so important to a healthy economy,” Jennifer Rabb, president of the Texas Taxpayers and Research Association, told the American-Statesman. “And without an extension of the credit, companies are going to choose to go elsewhere for those projects.”

Texas’ credit is on the low end of the spectrum for R&D tax incentives, with countries like China offering a “super deducation” of 200% and states like California offering a 15% tax credit on qualified research expenditures and an extra 24% of research payments to public universities and their affiliate hospitals or cancer research centers. Many other states, like Michigan and Arizona, offer 10%.

When asked during his testimony Wednesday if he believed the tax credit raise from 5% to 8.72% was enough, Bennett said it was a “great improvement” for Texas.

“Competitively speaking, we don’t have the highest tax credit available to R&D folks,” Bennett told the Statesman after the initial bill filing in March. “You absolutely have to have R&D going on in your industry sector to remain globally competitive, or you will be out of business.”

According to a study commissioned by Texans for Innovation, a group made up of state business associations lobbying to extend and improve the state’s R&D tax credit, expanding and making the tax credit permanent could increase the gross state product by up to 0.13% and could create 113,850 new jobs with an estimated $8.5 billion in wages by 2035.

Texans for Innovation includes groups like the Texas Association of Manufacturers, Texas Association of Business, Texas Healthcare and Bioscience Institute, Texas Taxpayers and Research Association, Texas Chemistry Council, Texas Oil & Gas Association, Texas Economic Development Council, several municipal chambers of commerce, Opportunity Austin and Lockheed Martin.

The credit, while driving an increase in high-paying full-time jobs at medium- and large-sized corporations, also aids small startups and entrepreneurial businesses, Texas Association of Business President and CEO Glenn Hamer told the Statesman. The Texas Association of Business is a member of Texans for Innovation.

“For those businesses, small entrepreneurial businesses that are startups that don’t have income coming in,” he said, “they would be able to take a credit off of their sales tax expenditures to use it or carry forward the credit to a time when they have profits coming in. What we love about this credit is that it’s something that’s available to all innovative companies in the state of Texas, regardless of their size.”

Opportunity Austin, also a member of the Texans for Innovation group, told the Statesman in a statement that one company working with it could access an estimated $4 million reinvestment capital thanks to an extension of the tax credit program.

“This initiative removes those barriers, freeing up millions in capital that fuels job creation, breakthrough advancements and sustained economic growth across multiple industries,” Opportunity Austin said.

Bennett said R&D is the backbone of the global, national and Texas economies, saying without investment in the area, the world suffers. Bennett pointed to Jack Kilby’s inventing of the microchip at Texas Instruments in 1958 as the perfect example as to why a tax credit is needed in the state.

“It’s just throughout our entire economy and daily life, that one R&D project created the world we live in today, which most people would say is a better world,” Bennett said. “It is absolutely essential that the state of Texas is competitive globally in this area, and the way you grow manufacturing, and you grow industries, and you grow jobs, and your economy is in large part due to basic research and development.”

Expanding R&D tax credits isn’t straightforward, as the loss in tax revenue could cost the state an estimated $661.4 million in fiscal 2026. However, Texans for Innovation argues that the economic benefits will offset this cost.

Sen. Donna Campbell, R-New Braunfels, while voting in favor of the bill, said the Legislature should contemplate whether or not the state has too many of these business or tax incentives or if it should slow down the dramatic growth Texas has experienced in recent years.

Now out of committee, SB 2206 will move to the Senate floor before heading to the House. HB 4393 is still in committee.

Some of those pushing for the passage of the bill said they expect some opposition, especially since it is an incentive increase.

But for many business leaders, Texas can’t afford not to extend and improve its R&D tax credit.

“It’s a must pass,” Hamer said. “We need to extend the R&D tax credit to remain competitive when it comes to R&D investment. So many other states, dozens of other states, have an R&D tax credit. … In terms of for the economic health of Texas, this is imperative.”

Diverse Coalition of Business, Industry Leaders Calls on Legislature to Support SB 2206/HB 4393 to Extend R&D Tax Credit, Cement Texas’ Leadership in Technology, Innovation

AUSTIN — A newly released economic impact study, commissioned by Texans for Innovation, found that extending the state’s research and development (R&D) tax credit will increase economic output, employment, and income, without creating fiscal problems at the state or local level. Specifically, the tax credit would create more than 113,000 jobs and generate $13.8 billion in additional Gross State Product (GSP) in the first 10 years. Texans for Innovation, a coalition of leaders that span the major business and industry sectors of the state, is calling on the Texas Legislature to extend the R&D tax credit due to expire in 2026 to grow the economy and cement Texas’ position as a leader in technology and innovation.

“For many industries like manufacturing, high-tech, energy, and biotechnology, the R&D process represents the critical ‘first phase.’ It’s where questions, ideas, and problems are fleshed out in labs, the field or production facilities to become the products and solutions that power the Texas economy,” said Tony Bennett, president and CEO of the Texas Association of Manufacturers and a founding member of Texans for Innovation. “These industries are the driving force in Texas’ economic growth and job creation and the state should be doing all it can to encourage growth in the sectors that are innovating the future of Texas.”

STUDY: “The Economic Effects of R&D Tax Incentives in Texas,” John W. Diamond, Ph.D., Edward A. and Hermena Hancock Kelly Senior Fellow in Public Finance | Director of the Center for Tax and Budget Policy, Baker Institute, Rice University, November 2024.

John W. Diamond, Ph.D., Edward A. and Hermena Hancock Kelly Senior Fellow in Public Finance and director of the Center for Tax and Budget Policy at Rice University’s Baker Institute, lead author of the study, said, “Our research demonstrates that an R&D tax credit will pay for itself by increasing the size of the Texas economy by more than enough to offset the cost of the incentive. The implication is clear. The question is not whether Texas can afford to extend the R&D tax credit, but instead whether Texas can afford not to extend the R&D tax credit. Extending the R&D tax credit at its current level is a first step, and it will definitely have a positive impact on the Texas economy, but a significant increase above the current level, whether now or in the future, is necessary if Texas wants to lead the nation in innovation and growth.”

Key findings from the study include:

Texas Lags in R&D Investment

- Despite being the second-largest state in population and GSP, Texas lags in R&D investment, ranking 33rd as a percentage of GSP.

- Texas’ existing R&D tax incentives have been intermittent and comparatively modest.

- As of 2022, Texas contributed only 4.3% of U.S. business-funded R&D, well behind leading states like California (36.2%).

- This gap suggests that Texas’ R&D policies need strengthening to remain competitive nationally and globally.

Economic Benefits of Enhanced R&D Tax Incentives

Expanding and making R&D tax credits permanent will generate significant economic benefits:

- GSP growth: Texas’ GSP could increase by up to 0.13% in the long run.

- Job creation and wages: By 2035, Texas could see 113,850 new jobs with an estimated $8.5 billion in wages.

- Investment boost: Total investment is projected to rise by 0.25% in the first year, with continued growth over the long term.

Revenue Offsets and Fiscal Responsibility

- While the initial cost of expanding R&D tax credits is estimated at $661.4 million in FY2026, the economic benefits will offset these costs over time.

- Increased economic activity will lead to higher state revenues, particularly from property and sales taxes, minimizing fiscal impacts.

- The study estimates that over 20 years, Texas could see a net economic gain of $58.8 billion after accounting for these offsets.

Policy Recommendations for Texas Lawmakers

- Extend and increase R&D tax credits beyond 2026 to foster a stable, long-term environment for innovation.

- Make these credits permanent to reduce uncertainty for businesses and attract more R&D investment to the state.

“With key R&D incentives set to expire, Texas risks losing ground to other states in research and development spending,” said Glenn Hamer, president and CEO of the Texas Association of Business. “Extending these incentives is critical to attracting high-tech industries, creating jobs, and maintaining Texas’ position as a national leader in technology and innovation. Ensuring long-term support for R&D strengthens our economy, workforce, and overall competitiveness.”

Members of Texans for Innovation include the Texas Association of Manufacturers, Texas Association of Business, Texas Healthcare and Bioscience Institute, Texas Taxpayers and Research Association, Texas Chemistry Council, Texas Oil & Gas Association, Texas Economic Development Council, Dallas Regional Chamber, Greater Houston Partnership, North Texas Commission, Opportunity Austin, and Lockheed Martin.

Click here to download a PDF version of the study.

Follow TAM on X (@TXManufacturers) and Facebook/TXManufacturers.

+++

The Texas Association of Manufacturers (TAM) actively represents more than 500 large and small companies from every manufacturing sector. Texas manufacturers employ more than 847,000 Texans in jobs that pay an average compensation of over $123,000 annually – roughly 36 percent higher than other non-farm Texas workers. Manufacturing accounts for 11.3 percent of the total output in the state, contributing more than $292 billion in 2023. On average, each manufacturing job created provides 5 additional jobs in our communities. Texas remains the number one exporting state for manufactured goods in the United States, now for more than 20 years running.

Media Contact: Gretchen Fox, 512-694-4326

#TAMis20

Visit TAM’s New Website: www.manufacturetexas.org

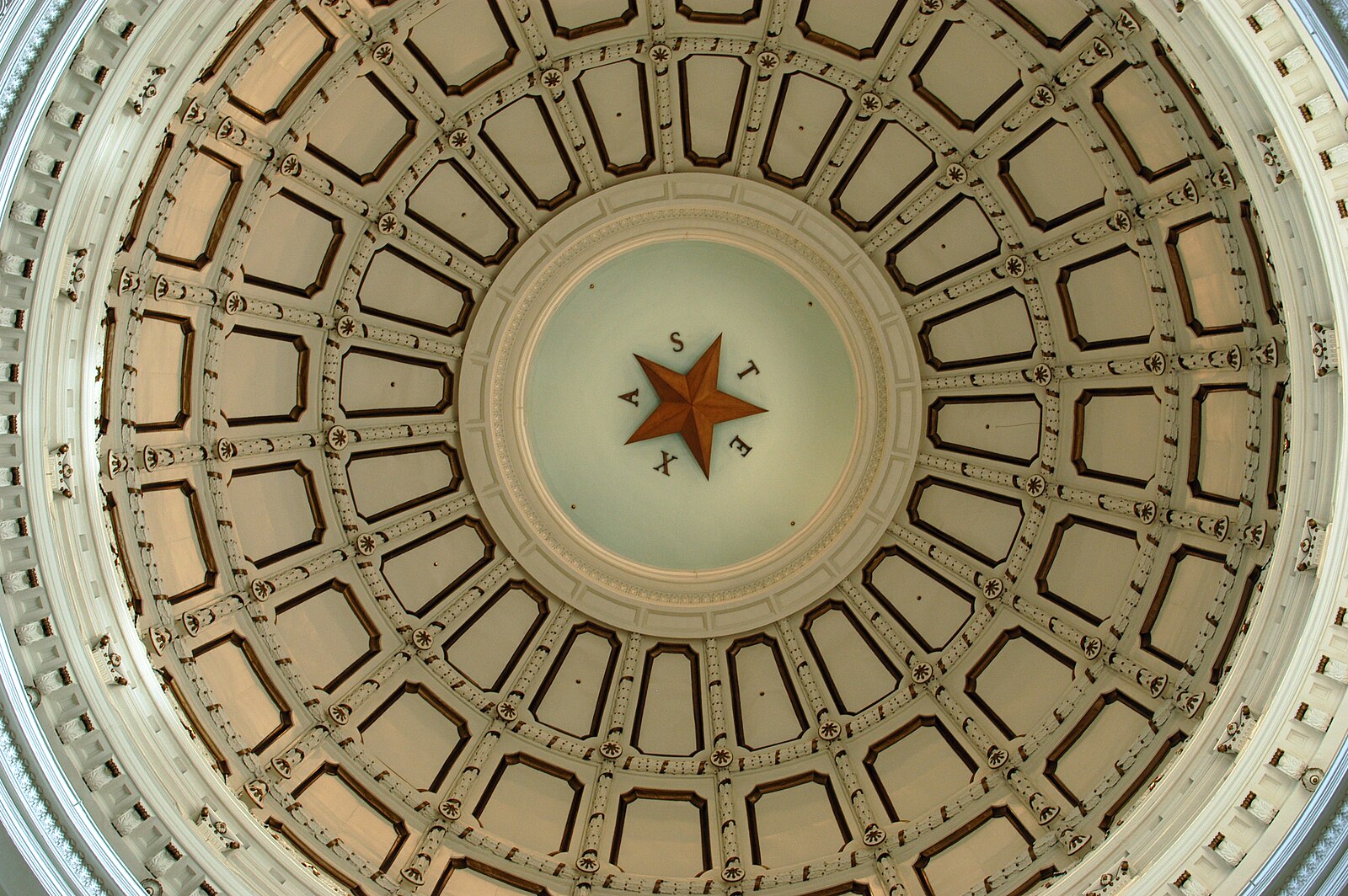

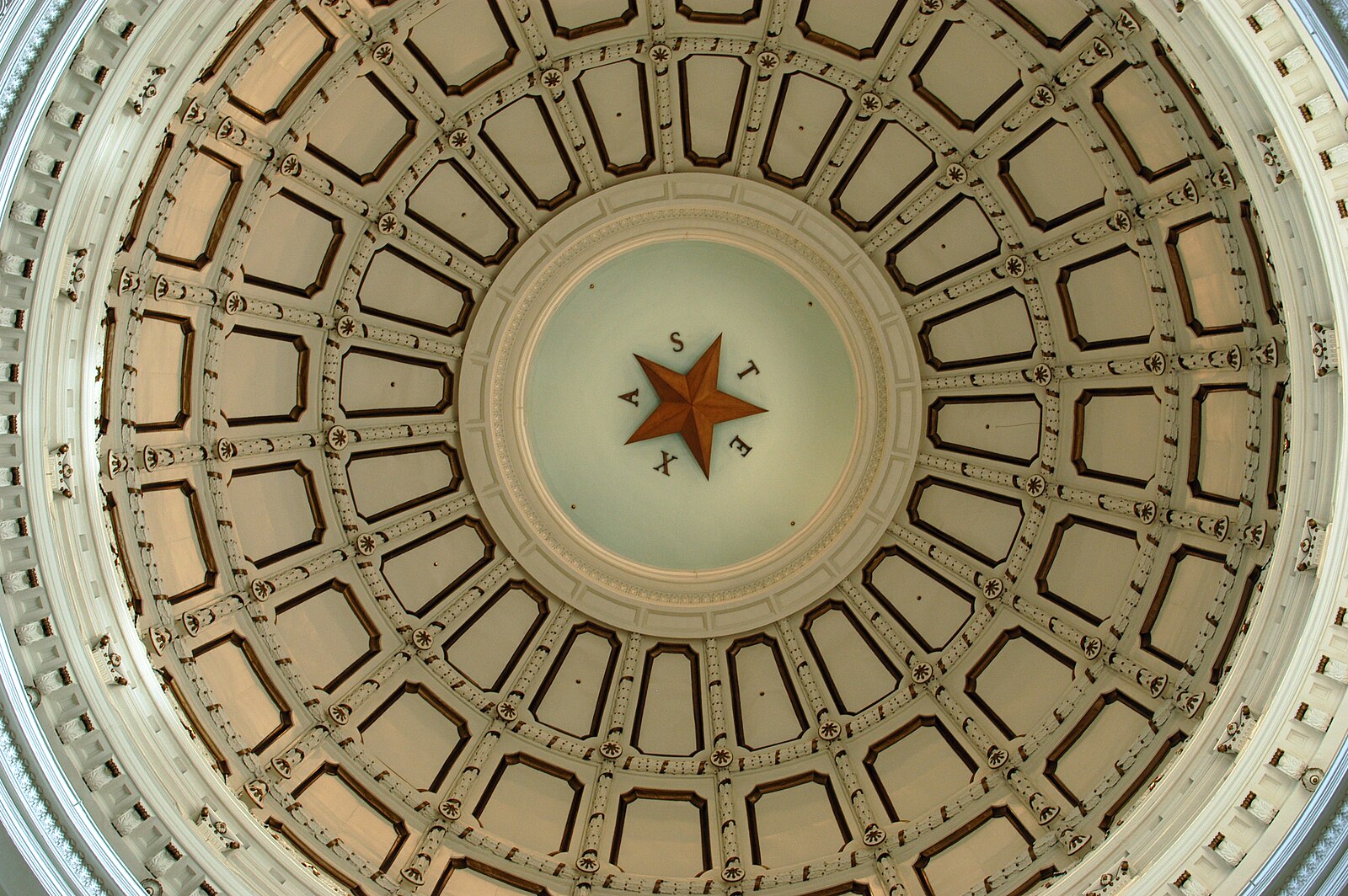

AUSTIN – The Texas Association of Manufacturers (TAM) kicked off its 20th anniversary celebration today in Austin at the 2025 Texas Manufacturers’ Day at the Capitol. Manufacturers from across the Lone Star State visited with their lawmakers to remind them how much #ManufacturingMatters to the state’s economy, jobs and national security.

“While much has changed since TAM opened its doors 20 years ago, one thing remains the same: Texas manufacturing is a major contributor to the Texas Miracle and the more than the 847,000 Texans who work in this industry have revolutionized the economy, saved lives, and made Texas stronger. It is my distinct honor to represent them and grow manufacturing in the Lone Star State,” said Tony Bennett, TAM’s current president and CEO and a founding member of the Association.

“Texas Manufacturers’ Day at the Capitol is our opportunity to remind lawmakers the importance of their continued policy leadership to keeping Texas on top. It’s no accident that Texas has been the number one exporting state for manufactured goods for more than two decades,” he said.

Today and throughout the 89th Legislature, TAM and its members are urging state leaders to focus on the TAM Top 10, the Association’s 2025 policy priorities crafted to protect Texas’ standing as the number one place to do business.

“Global competition to attract advanced manufacturing has never been more intense and our priorities and policies must be laser-focused on competitiveness,” said Bennett. “Smart policies related to pro-growth tax policy, transportation, infrastructure, electricity, workforce development and water are key to attracting and keeping large-scale manufacturing projects in Texas – which directly bolster our economy, strengthen our national and supply chain security and solidify our leadership in emerging technologies and advanced manufacturing.”

TAM’s Top 10 policy priorities in 2025 include:

- Tax Structures That Promote Economic Growth

- Equity in Business Taxation

- Business & Personal Property Tax Reform

- Transportation, Critical Infrastructure & Timely Permits

- Maintain a Reliable, Cost-Effective, and Competitive Wholesale Electricity Market

- Ensure that Monopoly Utility Rates are Transparent and Fair to Customers

- Career and Workforce Readiness

- Support Commonsense Regulations and Sufficient Funding for TCEQ Operations

- School and Workplace Health

- Funding for Water Infrastructure Projects

Learn more about the TAM Top 10 here.

Follow TAM on X (@TXManufacturers) and Facebook/TXManufacturers.

+++

The Texas Association of Manufacturers (TAM) actively represents more than 500 large and small companies from every manufacturing sector. Texas manufacturers employ more than 847,000 Texans in jobs that pay an average compensation of over $123,000 annually – roughly 36 percent higher than other non-farm Texas workers. Manufacturing accounts for 11.3 percent of the total output in the state, contributing more than $292 billion in 2023. On average, each manufacturing job created provides 5 additional jobs in our communities. Texas remains the number one exporting state for manufactured goods in the United States, now for more than 20 years running.

Media Contact: Gretchen Fox, 512-694-4326

AUSTIN – The Texas Association of Manufacturers (TAM), alongside several major Texas business associations, called on the U.S. Environmental Protection Agency (EPA) to support carbon capture and storage (CCS) in Texas in a joint letter to EPA Administrator Lee Zeldin.

In addition to TAM, the letter’s signatories include organizations representing some of the largest corporations and employers within the state, including the Texas Association of Business, Greater Houston Partnership, Texas Oil & Gas Association, Texas Economic Development Council, Texas Chemistry Council, and Economic Alliance Houston Port Region.

The Texas business community is pushing the EPA to accelerate its final decisions on Class VI well permits, the classification of underground injection well which allows for the permanent sequestration of carbon in rock formations deep below the ground. Without these wells, CCS projects cannot proceed.

“Texas has pioneered the development and deployment of low-carbon energy solutions like carbon capture and storage (CCS) that promise new investments, job growth and a boost to our state’s expansive energy portfolio,” said TAM President and CEO Tony Bennett. “Unfortunately, permitting delays at the federal level have plagued CCS progress in Texas. It can take the EPA up to five years to review a single Class VI well application, leaving potential projects in the lurch, stymying future investment and slowing progress towards a lower emissions future.”

“The State of Texas has applied to the EPA for primacy, a process that would alleviate backlogs by authorizing the Texas Railroad Commission to permit carbon wells in the state. The Commission has the experienced staff and resources to permit wells in under a year using the same rigorous safety and environmental standards used by the EPA,” he said. “Louisiana was recently granted primacy and if Texas’ application isn’t approved, we will lose out on investment – and jobs – to our neighboring state. We urge the EPA to move forward with the State’s primacy application to usher in the investment and jobs that belong in Texas.”

North Dakota, Wyoming, Louisiana, and West Virginia, have all been granted primacy from the EPA. Texas submitted its application for Class VI primacy in 2022, but remains in the “pre-application activities phase” on the EPA’s tracker.

The complete letter to the EPA can be found here.

+++

Media Contact: Gretchen Fox, 512-694-4326

TAM President & CEO Tony Bennett: “Global competition for advanced manufacturing has never been more intense. Priorities and policy must be laser-focused to keep Texas on top.”

AUSTIN –The Texas Association of Manufacturers (TAM) today released its “TAM Top Ten,” which details the Association’s policy priorities for the 89th Legislature in 2025.

“Global competition to attract advanced manufacturing has never been more intense and our priorities and policies must be laser-focused on ways to keep Texas on top as the number one state to do business and the number one state for exported manufactured goods,” said Tony Bennett, president and CEO of TAM. “Smart policies related to pro-growth tax policy, transportation, infrastructure, electricity, workforce development and water are key to attracting and keeping large-scale manufacturing projects in Texas – which directly bolster our economy, strengthen our national and supply chain security and solidify our leadership in emerging technologies and advanced manufacturing.”

TAM’s Top Ten policy priorities include:

- Tax Structures That Promote Economic Growth

- Equity in Business Taxation

- Business & Personal Property Tax Reform

- Transportation, Critical Infrastructure & Timely Permits

- Maintain a Reliable, Cost-Effective, and Competitive Wholesale Electricity Market

- Ensure that Monopoly Utility Rates are Transparent and Fair to Customers

- Career and Workforce Readiness

- Support Commonsense Regulations and Sufficient Funding for TCEQ Operations

- School and Workplace Health

- Funding for Water Infrastructure Projects

More on TAM Top 10:

- Tax Structures That Promote Economic Growth

- SUPPORT: A competitive tax climate that incentivizes investment by new and existing businesses, including the new Jobs, Energy, Technology and Innovation (JETI) Act, a robust research and development (R&D) tax exemption and a consistent tax exemption for the maintenance, repair and overhaul (MRO) of general aviation aircraft.

- Equity in Business Taxation

- SUPPORT: Broad-based, low-rate tax policy that treats all taxpayers equally, recognizing that no franchise tax cut is a substitute for a competitive property tax environment.

- Business & Personal Property Tax Reform

- SUPPORT: Exempting either equipment used directly in the manufacturing process, or alternatively, all business inventories. This would provide competitive tax relief for all kinds of businesses and industries, large and small, and would create an ongoing and powerful stimulus for the Texas economy.

- Transportation, Critical Infrastructure & Timely Permits

- SUPPORT: Policies that will facilitate the flow of both interstate and intrastate commerce, alleviate supply chain disruptions and encourage efficient expansion – and timely permitting – of our infrastructure network of pipelines, utility rights-of-way, highway and rail corridors that will sustain the quality business environment in Texas.

- Maintain a Reliable, Cost-Effective, and Competitive Wholesale Electricity Market

- SUPPORT:Ensuring reliability and affordability by relying on market-based pricing for energy, ancillary services, and operational reserves; providing price signals for market participants who perform when the grid needs it most; offering robust demand response opportunities; limiting “out-of-market” actions, direct capacity procurements, and capacity markets.

- Ensure that Monopoly Utility Rates are Transparent and Fair to Customers

- OPPOSE:“Rate riders” that let monopoly utilities increase rates quickly, with very limited review. TAM’s priority is to protect the ratemaking process against ongoing utility efforts to reduce oversight and transparency and to ensure that Texas businesses are not forced to pay more than they should for electricity.

- Career and Workforce Readiness

- SUPPORT: Robust career and technical education (CTE) programs and funding in all school districts, as well as a strong system of career, college and military advising beginning in middle school, with a particular emphasis on “return on investment” and a recognition that many careers do not require a 4-year degree, which is often accompanied by crippling student loan debt.

- SUPPORT: A strong accountability system for both public schools and institutions of higher education, with outcomes being paramount.

- SUPPORT: High-quality workforce training programs and funding that provide exceptional rate of return for the Texas economy — programs administered by the Texas Workforce Commission and local workforce boards including: the Skills Development Fund (SDF), Jobs and Education for Texans (JET) Program, and learn-while-you-earn apprenticeships.

- Support Commonsense Regulations and Sufficient Funding for TCEQ Operations

- SUPPORT: TCEQ’s use of clear and consistent regulations that have a market-driven and incentive-based foundation rather than heavy handed mandates or a one-size-fits-all approach, as well as increased inspections at manufacturing facilities that are consistent across the state’s geographic regions.

- SUPPORT: Providing adequate funding for Texas Commission on Environmental Quality (TCEQ) to ensure the agency has the resources and staff they need to efficiently process permits, hire additional inspectors, and provide enhanced salaries and training opportunities for TCEQ staff to maintain a qualified, experienced workforce.

- School and Workplace Health

- SUPPORT: Policies that encourage prevention of infectious disease in schools and the workplace and eliminate attempts to create barriers and access to vaccinations for employees and communities.

- Funding for Water Infrastructure Projects

- SUPPORT: Establishing a dedicated funding stream for the Texas Water Fund to support Texas’ population and economic growth, as well as additional market-based solutions that proportionally distribute any costs in developing regional water infrastructure among end users.

- SUPPORT: Water reuse incentives and sustainability initiatives developed in collaboration with innovative manufacturing partners to reduce the burden on water infrastructure.

Follow TAM on X (@TXManufacturers) and Facebook/TXManufacturers.

+++

The Texas Association of Manufacturers (TAM) actively represents more than 500 large and small companies from every manufacturing sector. Texas manufacturers employ more than 847,000 Texans in jobs that pay an average compensation of over $123,000 annually – roughly 36 percent higher than other non-farm Texas workers. Manufacturing accounts for 11.3 percent of the total output in the state, contributing more than $292 billion in 2023. On average, each manufacturing job created provides 5 additional jobs in our communities. Texas remains the number one exporting state for manufactured goods in the United States, now for more than 20 years running.

Media Contact: Gretchen Fox, 512-694-4326

CORE SECTORS

Discover the core manufacturing sectors that are making significant impacts, driving progress and leading in innovation in Texas.

The Texas Association of Manufacturers proudly represents the diverse array of sectors that drive our economy and keep us safe. From energy, aerospace and defense to chemistry products in plastics, pharmaceuticals and advanced semiconductors, Texas manufacturing improves, saves and protects lives every day.

Guiding PRINCIPLES

At the Texas Association of Manufacturers, our principles are the foundation of our advocacy and action.

We are dedicated to fostering a pro-growth environment where manufacturing thrives through sensible policies and strong industry standards. Our guiding principles address key areas such as energy, environmental policy, tax and economic development, transportation, workforce, and legal reform. Each principle is crafted with the goal of protecting and growing high-quality jobs, ensuring Texas remains at the forefront of manufacturing competitiveness and innovation. This commitment shapes our efforts at both the state and national levels, advocating for conditions that allow our industries to flourish and contribute to a prosperous Texas.

ENERGY

Manufacturers are by far the largest consumers of electricity in the State of Texas. The rising cost of energy continues to play a pivotal role in capital investment location decisions across the nation and around the globe.

- The development of market-based energy sources that will provide Texas with reliable and competitively-priced energy.

- An appropriate sharing of transmission infrastructure costs between producers and consumers of electricity.

- Streamlining the environmental permit processes to allow for more timely expansion of cost-effective electricity and other energy supplies.

- Allowing market-based, cost-effective resources, including load response, to compete in electricity markets.

- Effective oversight over the rates and services of monopoly electric utilities, which may include generation, transmission and/or distribution.

- Requiring accurate consumer cost fiscal notes for all energy-related initiatives and proposals.

- Favoring certain energy technologies over others through the use of mandates or subsidies.

- Mandated capacity markets that create unwarranted wealth transfers from electric consumers to generators.

- Allowing monopoly utilities to increase rates without comprehensive rate reviews and effective oversight.

- Taxes and fees on energy consumption.

- Increasing bureaucracy or regulatory burdens that will inhibit the efficient development of competitive energy sources.

ENVIRONMENT

TAM knows that being pro-business and pro-environment are not mutually exclusive policy objectives. Texas manufacturers have been working diligently over several decades to improve air quality in Texas and are leading innovators in technologies to protect and improve the environment. TAM supports environmental policies that are based on sound science and that protect the environment while allowing the economy to grow.

AIR

TAM SUPPORTS

- Maintaining current, ongoing initiatives which have dramatically improved air quality in Texas and do not interfere with enforcement of existing, effective state and federal air quality standards.

- Encouraging continued industry investment in technologically and economically feasible emission reduction solutions through market-driven measures rather than mandates.

- Maintaining automobile fleet turnover programs such as Low-Income Repair Assistance Program (LIRAP) that promote cleaner automotive usage and dramatically reduce mobile emissions.

- Maintaining cost-effective programs like Texas Emissions Reduction Plan (TERP) that are critical to reduce air emissions.

- Making air quality attainment requirements feasible to avoid unrealistic plans that risk Texas transportation funding, halt road construction and accelerate manufacturing job loss and relocation.

WATER

TAM SUPPORTS

- Promoting market-based solutions to meet the state’s water needs.

- Proportionally distributing any costs in developing regional water infrastructure among end users.

- Promoting water reuse incentives and sustainability initiatives developed in collaboration with innovative manufacturing partners to reduce the burden on proposed water infrastructure.

WASTE

TAM SUPPORTS

- Broad-based, comprehensive solutions to solid waste reduction.

TAXES & ECONOMIC DEVELOPMENT

Manufacturing is an important contributor to economic growth and tax receipts at all levels of government. Texas must maintain tax policies and economic development programs that support Texas manufacturers and make Texas more competitive in attracting new manufacturers, sustaining existing manufacturing and creating new jobs for Texans.

TAM SUPPORTS

- Keeping Texas on the competitive cutting edge to attract manufacturers and grow jobs.

- Maintaining the Texas Economic Development Act agreements under Chapter 312 and 313 of the Tax Code and renewing the Texas Enterprise Fund.

- Maintaining the structural integrity of Texas’ margins tax while seeking legislative and administrative technical changes and/or clarifications to create greater clarity and fairness in the business tax.

- Fostering a competitive business tax environment that reflects broad-based, fairly distributed taxes at the state and local levels.

- Maintaining a tax incentive for research and development, capital investment and job creation.

TAM OPPOSES

- Attempts to further distinguish tax rolls of residential and commercial entities, such as appraisal caps.

- Increases in local option sales taxes beyond the current cap.

TRANSPORTATION

The manufacturing sector depends on a reliable and efficient multi-modal transportation system in order to move goods.

TAM SUPPORTS

- Promoting a market-driven, cost-effective transportation infrastructure that allows efficient and competitive transport through the seaports, land ports, roads, railroads and pipelines of Texas.

- Transportation policy that increases productivity, reduces logistics costs for U.S. manufacturers, reduces fuel consumption and emissions, and relieves congestion — making Texas a more competitive, cleaner environment.

- Encouraging expeditious flow of goods, which improves the environment, promotes efficiency and benefits consumers through reduced costs.

WORKFORCE DEVELOPMENT

Historically, the manufacturing sector has been a primary source for middle-class jobs, especially for workers without a college degree. Today’s manufacturing is diversified and requires highly-skilled workers with education and training of all kinds, from welders to engineers. We need to counter the notion that all high-quality manufacturing jobs require a traditional four-year college degree.

TAM SUPPORTS

- Fostering an effective, efficient and standards-based education system that meets the needs of the Texas manufacturing industry and its wide array of employment opportunities.

- Providing an incentive to public school districts, public and private universities, community colleges and technical schools to increase the number of graduates in critical fields such as engineering, math, science and career and technologies.

- Encouraging rigorous yet flexible high school graduation pathways that lead to post-secondary success; including accountable and relevant programs to meet diverse manufacturing workforce needs.

- Ensuring that the state public education system supports and rewards local school districts wishing to offer career and technology courses that help meet their local employment demands.

- Ensuring that career and technology courses offered by school districts contain applied math and/or science components and qualify for credit for math and/or science toward flexible degree plans.

- Ensuring that in-state universities recognize and honor junior college career and technology-based courses.

LAWSUIT REFORM & EMPLOYER ISSUES

Texas Association of Manufacturers and its members are committed to sustaining economic growth and defending against attempts to rollback more than two decades of landmark civil justice reform.

TAM SUPPORTS

- A fair and equitable civil justice system that promotes a sound business environment capable of attracting and retaining manufacturing jobs.

Key Initiatives

Explore TAM’s Top 10 Priorities, a carefully crafted list of strategic initiatives aimed at enhancing Texas’ manufacturing competitiveness.

These priorities represent some of the most pressing issues and opportunities identified by the Texas Association of Manufacturers, focusing on legislative, regulatory, and policy actions that can significantly impact the industry. From advocating for tax reforms to enhancing infrastructure and promoting technological innovation, each priority is chosen to safeguard and advance Texas’ position as a national leader in manufacturing. This list helps guide our advocacy efforts and aligns with our mission to ensure a competitive and flourishing manufacturing sector in Texas.

TAM supports a competitive tax climate that will incentivize investment by new and existing businesses. Sometimes, the State of Texas must adjust how taxes are applied in order get the attention of capital-intensive projects. Simply said, strategically and temporarily limiting tax…

The Texas Legislature reformed the franchise tax over a decade ago to better reflect the modern sectors of the Texas economy, close tax loopholes, and to help finance a reduction in the school property tax. Legislative sentiment periodically favors a phase-out…

Some states have completely exempted business personal property from their property tax assessments to grow their economies; Texas is not one of them. Business personal property includes assets that can be moved – furniture, equipment, and…

Manufacturing plants are energy intensive operations and require well-orchestrated logistics to receive raw materials and supplies and then ship finished products to customers worldwide. These activities require an ever-expanding network of transportation…

Following Winter Storm Uri, incumbent generators have increasingly sought government-mandated, fixed payments from customers to compensate them for simply owning existing generation facilities. These proposals have caused substantial…

Electricity is among the top three production costs for most manufacturers. Regulated monopoly utilities continuously ask for “rate riders” that let them increase rates quickly, with very limited review. These rate riders can disadvantage utility customers…

TAM supports flexible yet rigorous pathways in K-12 public schools and higher education, recognizing there are many pathways to career success. Texas’ education system must be aligned to prepare students to meet the diverse and evolving needs of employers…

TAM supports the Texas Commission on Environmental Quality’s (TCEQ) continued Sunset legislation implementation (SB 1397) efforts. TAM also supports the use of clear and consistent regulations that have a market driven and incentive-based foundation rather…

A healthy workforce results in a more productive workforce. Our global economy can be impacted quickly due to widespread illness, resulting in slowed manufacturing, the inability to get goods to consumers, job losses, and lost tax revenue. Every…

As Texas’ population continues to grow, and the State’s economy along with it, it is imperative that we have the infrastructure in place to support that growth. Water infrastructure must be part of this planning conversation. Accounting for this growth, the 2022 State Water…

JOIN US

Join the Texas Association of Manufacturers and propel your business to the forefront of the industry.

As a TAM member, you’ll gain crucial advocacy and resources and connect with peers, elected officials and regulators through networking opportunities that shape policy. Leverage our comprehensive advocacy and policy support to ensure your voice is heard in legislative matters that impact your operations and the industry at large.

MEMBERSHIP BENEFITS

Texas manufacturers are pivotal to both state and national prosperity.

As your advocate in Austin and Washington D.C., TAM champions policies that drive sector growth and job creation, ensuring that over 847,000 manufacturing professionals in Texas continue to thrive amid evolving legislative and regulatory landscapes.

TAM’s public policy advocacy amplifies the voices of manufacturers, ensuring our industry is connected to lawmakers.

Stay informed and ahead of industry trends with exclusive access to news clips and updates.

Engage in policy collaboration with your manufacturing sector colleagues, which will shape the future of manufacturing in Texas.

REACH OUT

Follow the Texas Association of Manufacturers to keep up to-date with manufacturing news, or reach out to our team.

TEXAS ASSOCIATION OF MANUFACTURERS WORKERS’ COMP INSURANCE PROGRAM

Underwritten by Texas Mutual Insurance Company

PO Box 50565, Austin, TX 78763

512-906-2000

www.tamworkerscomp.com

stacy.looney@tamworkerscomp.com

Gretchen Fox

512-694-4326

gfox@gfoxconsulting.com